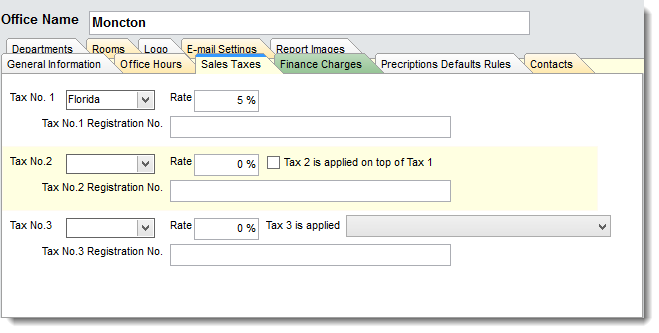

Users can create up to 3 taxes to be applied on an Invoice. In the office setting, you can set for each office, the appropriate sales tax.

Tax # 3 can be applied on top of the one or both of the other taxes or independently ( see Tax 3 Is applied drop down field for options).

Default Tax Rates: These are the tax rates used by Filopto for invoicing purposes. Each office may have a different tax rate. Three sales tax rates are available for use. Tax rate 1 is applied on the total items/services sold. Tax rate 2 is applied in the same manner as tax rate 1 unless the checkbox field is activated (placing a check mark). If the checkbox field Tax 2 is applied on top of Tax 1 has a check mark then tax 2 is applied as follows: (Total of all items/services + Tax 1 amount ) * Tax Rate 2. (piggyback tax). Tax rate 3 can be applied in various manners depending on the selected method identified by the drop box.

The actual tax rates are entered in the System Settings/Accounting/Sales Tax section of Filopto.

Federal Tax Identification/GST/PST/QST/HST: Taxation and Business Registration Numbers

In several jurisdictions, it is a requirements that the taxation registration numbers appear on all invoices. For taxation purposes, we have included Federal Tax and State Tax registration number field. The information from the company setting fields is automatically included on the standard Invoices. However you can modify the standard invoice for it to retrieve the office information instead of the corporate information.